mobile county al sales tax registration

Property record and appraisal information are for appraisal use only and. Pistol Permit Mobile Al Fill Online Printable.

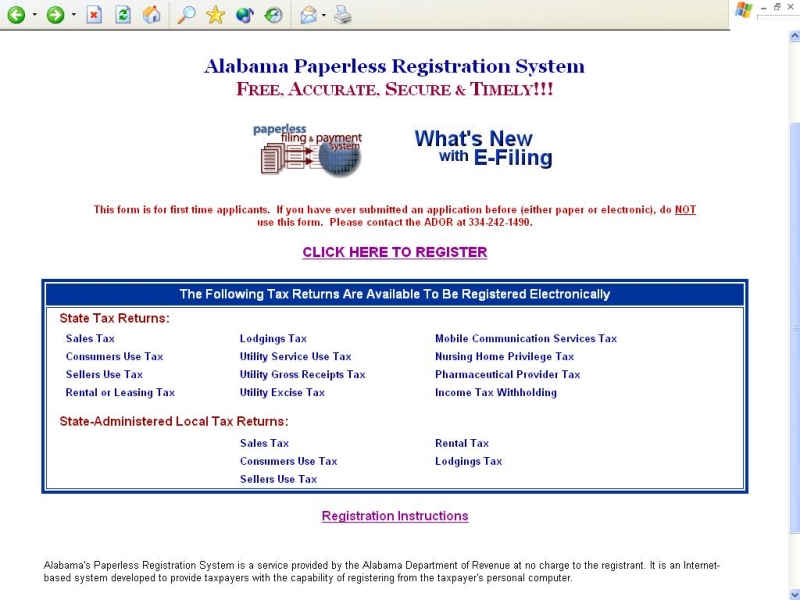

Sales Tax Alabama Department Of Revenue

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd.

. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. This is the total of state county and city sales tax rates. Per 40-2A-15h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered county or municipality may.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as. We track the following licenses with the Mobile County Sales Tax Department AL in order to provide compliance services to our clients. The minimum combined 2022 sales tax rate for Mobile Alabama is 10.

The Alabama sales tax rate is currently 4. 10 rows Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as. In Mobile Downtown office is.

Once you register online it takes 3-5 days to receive an account number. Instructions for uploading a file. The Alabama state sales tax rate is currently 4.

Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23fee 150 minimum for each registration year renewed as well as. However However pursuant to Section 40-23-7. Section 34-22 Provisions of state sales tax statutes applicable.

The December 2020 total local sales tax rate was also 10000. VALUES DISPLAYED ARE 2022 PRELIMINARY VALUES AND ARE SUBJECT TO CHANGE PRIOR TO CERTIFICATION. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal.

In Mobile or our Downtown Mobile office at 151 Government St. Mobile AL Sales Tax Rate. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

The minimum combined 2022 sales tax rate for Mobile County Alabama is 10. As a client you see this and other reference data in. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales.

30 penalty will be assessed beginning March 1st. Overview Employment Chamber of Commerce Business Licenses Alarm Permits Registration Work with Mobile. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

Mobile County Al Sales Tax Registration. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. Applicable interest will be assessed beginning February.

Build Mobile Permitting Planning and Zoning Self-Service. This is the total of state and county sales tax rates. If you have questions please contact our office at.

15 penalty will be assessed beginning February 1st through February 28th. Vendor Registration Payment Center Tax Payments Bids Real Estate Listings Auctions Financial Reports Revenue Department. The current total local sales tax rate in Mobile AL is 10000.

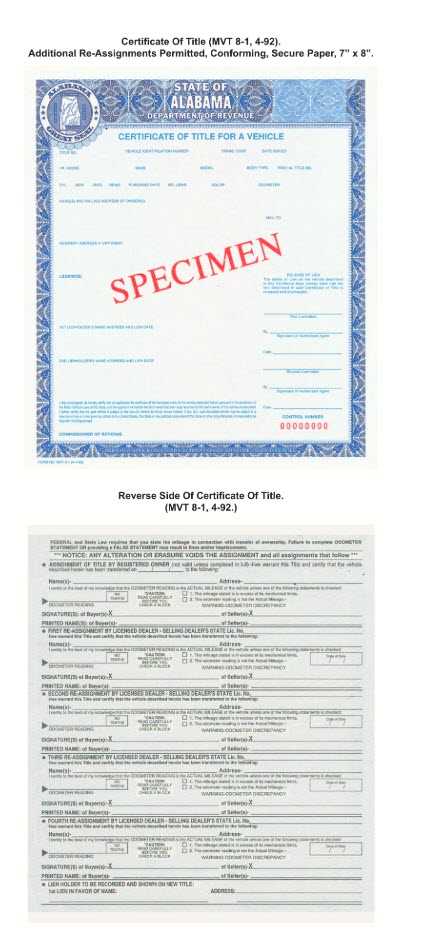

Alabama Tax Title Registration Requirements Process Street

Toyotathon Sales Event Near Me In Mobile Al Palmer S Toyota Superstore

Alabama Tax Title Registration Requirements Process Street

Why Alabama S Taxes Are Unfair Al Com

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

Easytag Automobile Registration Made Simple

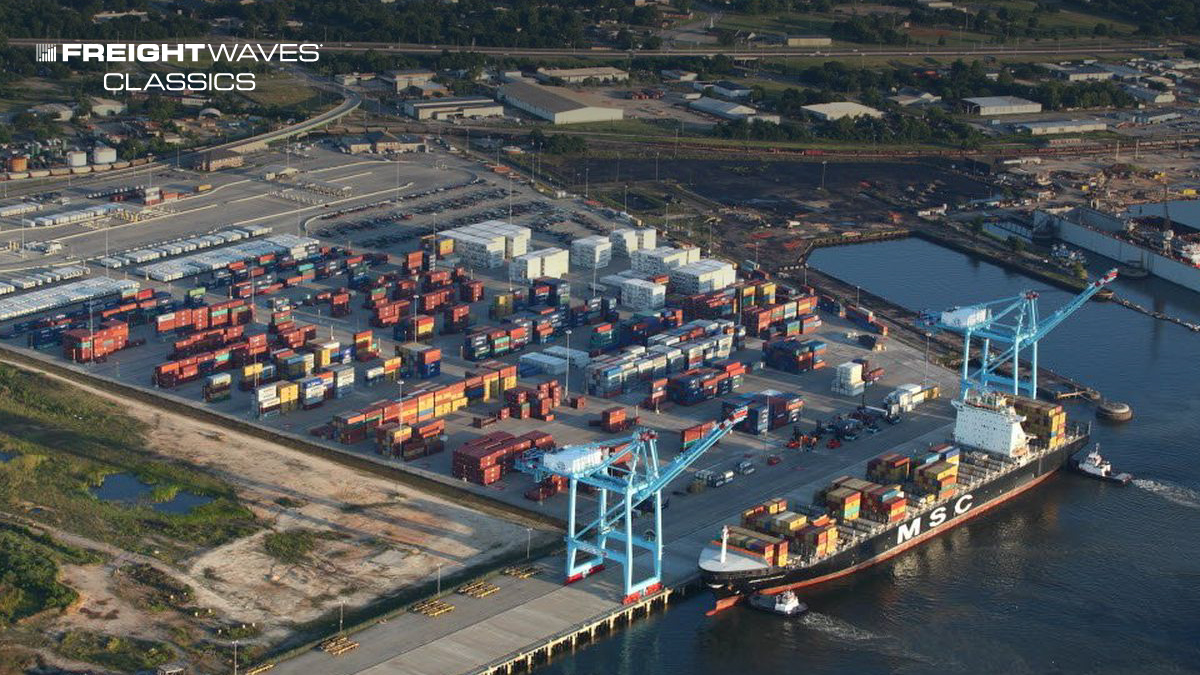

Evonik Investing 176 5 Million In Mobile County Site Expansion Al Com

Sales Tax Alabama Department Of Revenue

How To Register For A Sales Tax Permit In Alabama Taxvalet

Alabama Llc How To Start An Llc In Alabama In 11 Steps Starting Up 2022

Sales And Use Alabama Department Of Revenue

Sales Tax Holidays Politically Expedient But Poor Tax Policy

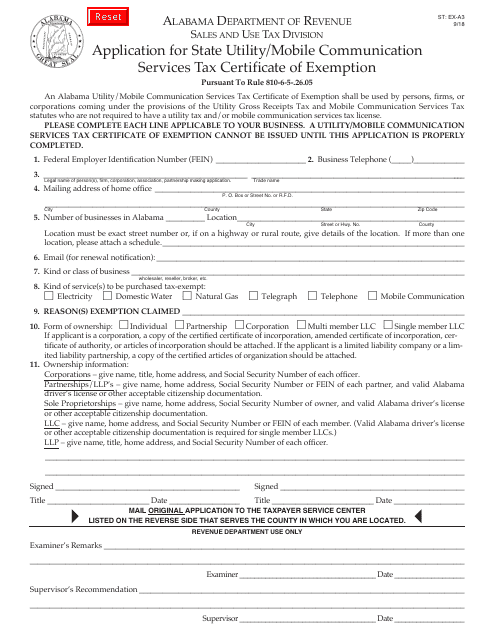

Form St Ex A3 Fillable Application For State Utility Mobile Communication Services Tax Certificate Of Exemption And Instructions

Alabama Department Of Revenue Forms Pdf Templates Download Fill And Print For Free Templateroller

Freightwaves Classics Port Of Mobile Is A Key Gulf Coast Port Freightwaves